What is a California Gift Deed?

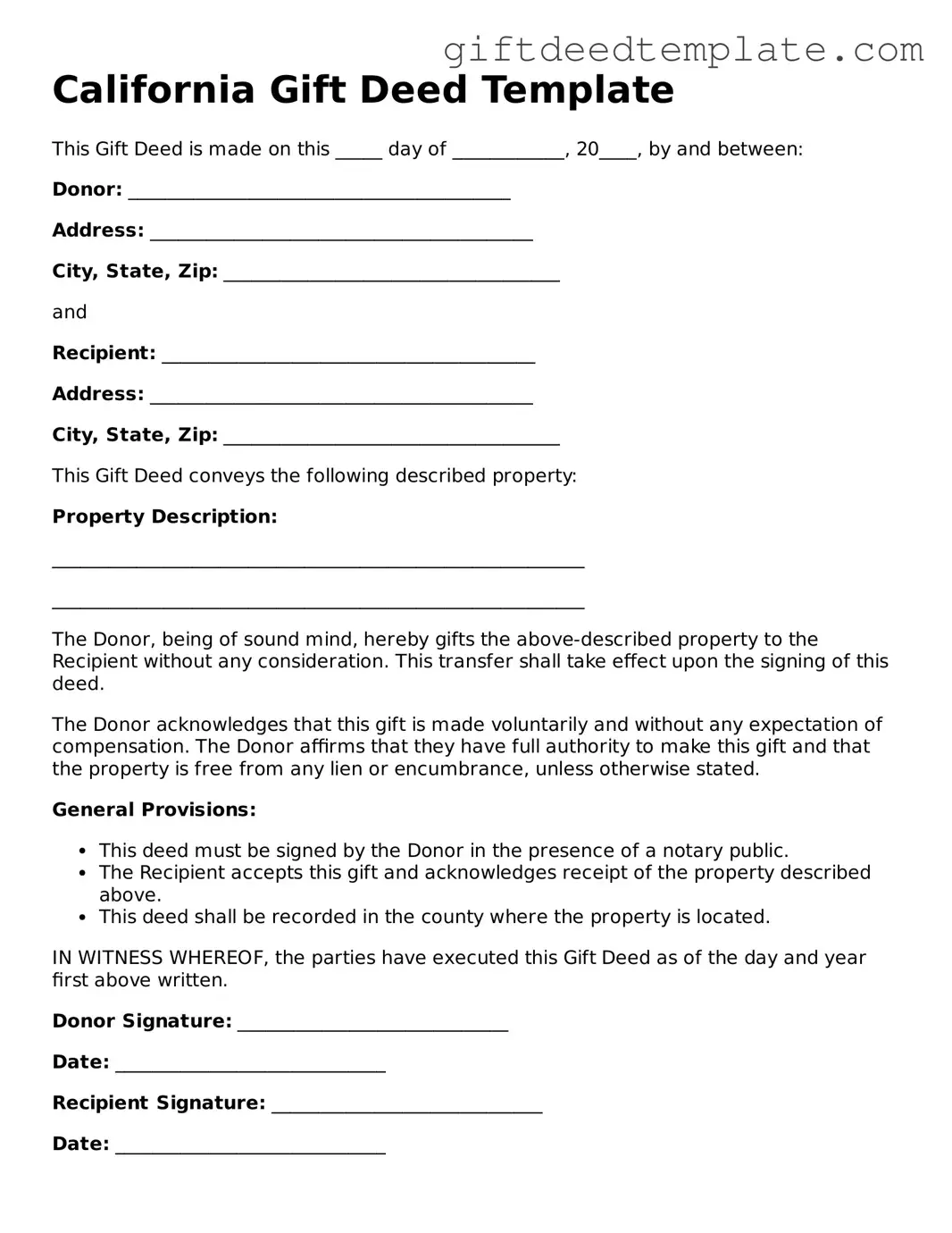

A California Gift Deed is a legal document used to transfer property ownership without any exchange of money. It allows one person (the donor) to give property to another person (the recipient) as a gift. This deed must be properly executed and recorded to ensure the transfer is legally recognized. It is often used between family members or friends to simplify the process of transferring property ownership.

What information is required to complete a Gift Deed?

To complete a Gift Deed, you will need to provide specific information, including the names and addresses of both the donor and the recipient. You must also include a legal description of the property being gifted, such as its address or parcel number. Additionally, the deed should state that the transfer is a gift and not a sale. Both parties must sign the deed, and it should be notarized to validate the signatures.

Are there any tax implications associated with a Gift Deed?

Yes, there can be tax implications when transferring property via a Gift Deed. The donor may need to file a gift tax return if the value of the gift exceeds the annual exclusion limit set by the IRS. However, there is also a lifetime gift tax exemption that may apply. The recipient usually does not pay taxes upon receiving the gift, but it is essential to consult a tax professional for personalized advice regarding your specific situation.

How do I record a Gift Deed in California?

To record a Gift Deed in California, you need to take the completed and notarized document to the county recorder's office in the county where the property is located. There may be a small fee for recording the deed. Once recorded, the Gift Deed becomes part of the public record, which helps protect the recipient's ownership rights. It is advisable to obtain a copy of the recorded deed for your records.

Can a Gift Deed be revoked or changed after it is executed?

Once a Gift Deed is executed and recorded, it generally cannot be revoked or changed unilaterally. The transfer of ownership is considered final. However, if both the donor and the recipient agree, they can create a new document to reverse the gift or modify the terms. Legal advice may be necessary to navigate this process effectively.