What is a Georgia Gift Deed?

A Georgia Gift Deed is a legal document used to transfer property ownership from one individual to another without any exchange of money. This type of deed is often used when a property owner wishes to give their property as a gift to a family member or friend.

What information is required to complete a Gift Deed?

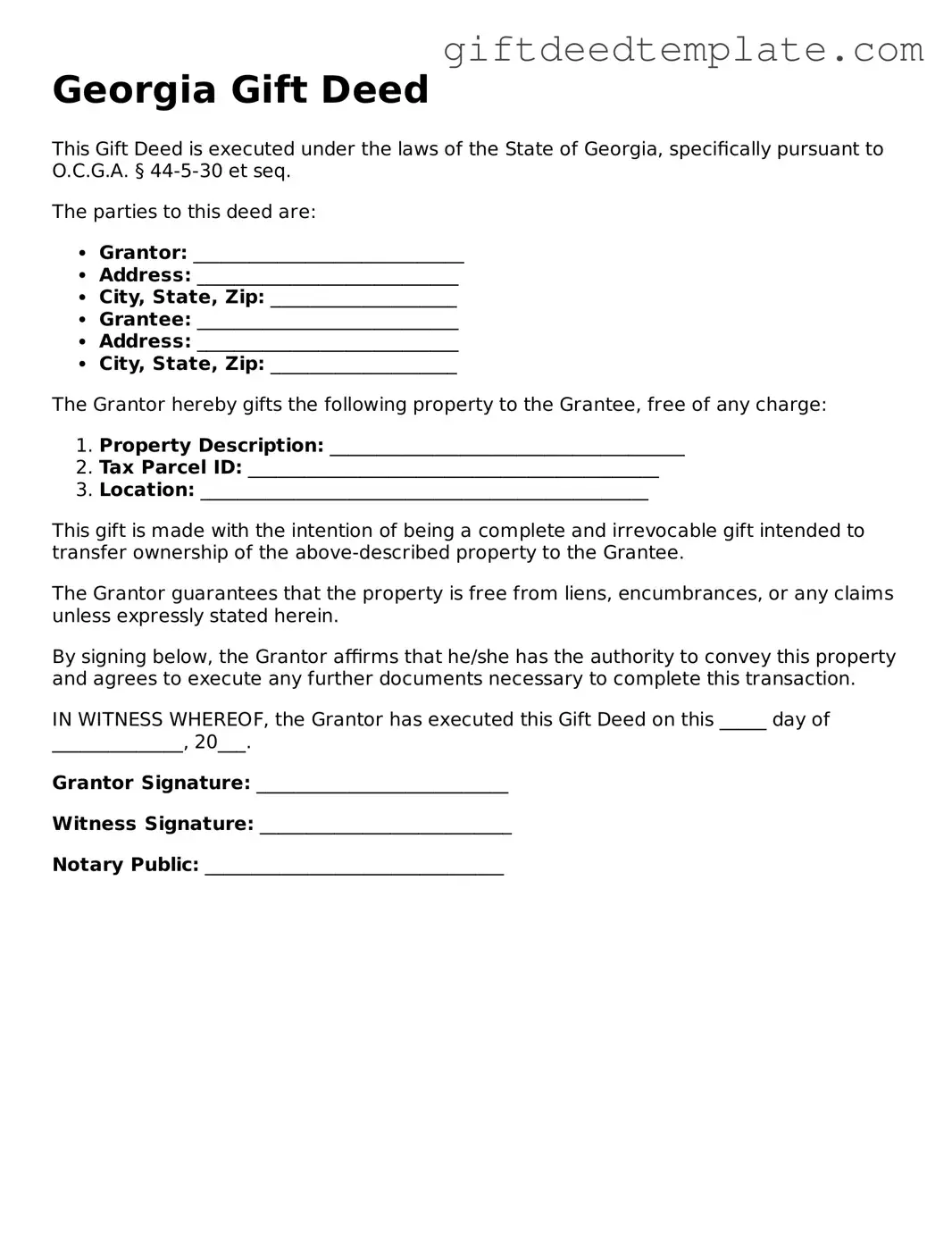

To complete a Gift Deed in Georgia, you will need the names and addresses of both the donor (the person giving the gift) and the recipient (the person receiving the gift). Additionally, a legal description of the property being transferred is necessary, along with the signature of the donor and a notary public.

Is a Gift Deed taxable in Georgia?

While a Gift Deed itself does not incur transfer taxes in Georgia, it may have implications for federal gift tax. The donor should consult with a tax professional to understand any potential tax liabilities associated with gifting property.

Do I need to record the Gift Deed?

Yes, it is advisable to record the Gift Deed with the county clerk's office where the property is located. Recording the deed provides public notice of the transfer and helps protect the recipient's ownership rights.

Can a Gift Deed be revoked?

Once a Gift Deed is executed and delivered to the recipient, it is generally considered irrevocable. However, if the deed contains specific conditions or if the donor retains certain rights, there may be grounds for revocation. Legal advice should be sought in such cases.

What are the benefits of using a Gift Deed?

A Gift Deed allows for a straightforward transfer of property without the need for monetary compensation. It can simplify estate planning and may help avoid probate in some situations. Additionally, it can strengthen familial relationships by facilitating property transfers among family members.

Are there any restrictions on who can receive a Gift Deed?

In Georgia, any individual or entity can receive a Gift Deed, provided that the donor has the legal capacity to transfer the property. However, certain restrictions may apply if the recipient is a minor or if the property is subject to specific legal constraints.

What happens if the donor dies after executing a Gift Deed?

If the donor passes away after executing a Gift Deed, the property will belong to the recipient as outlined in the deed. The property will not be included in the donor's estate, which can simplify the estate settlement process.

Can I use a Gift Deed for real estate only?

A Gift Deed is primarily used for real estate transactions. However, it can also be used for other types of property, such as vehicles or personal belongings, though the process may differ for those items.

Where can I obtain a Georgia Gift Deed form?

Georgia Gift Deed forms can be obtained from various sources, including legal stationery stores, online legal document providers, or through an attorney. It is important to ensure that the form complies with Georgia state laws to ensure its validity.