More About Texas Gift Deed

What is a Texas Gift Deed?

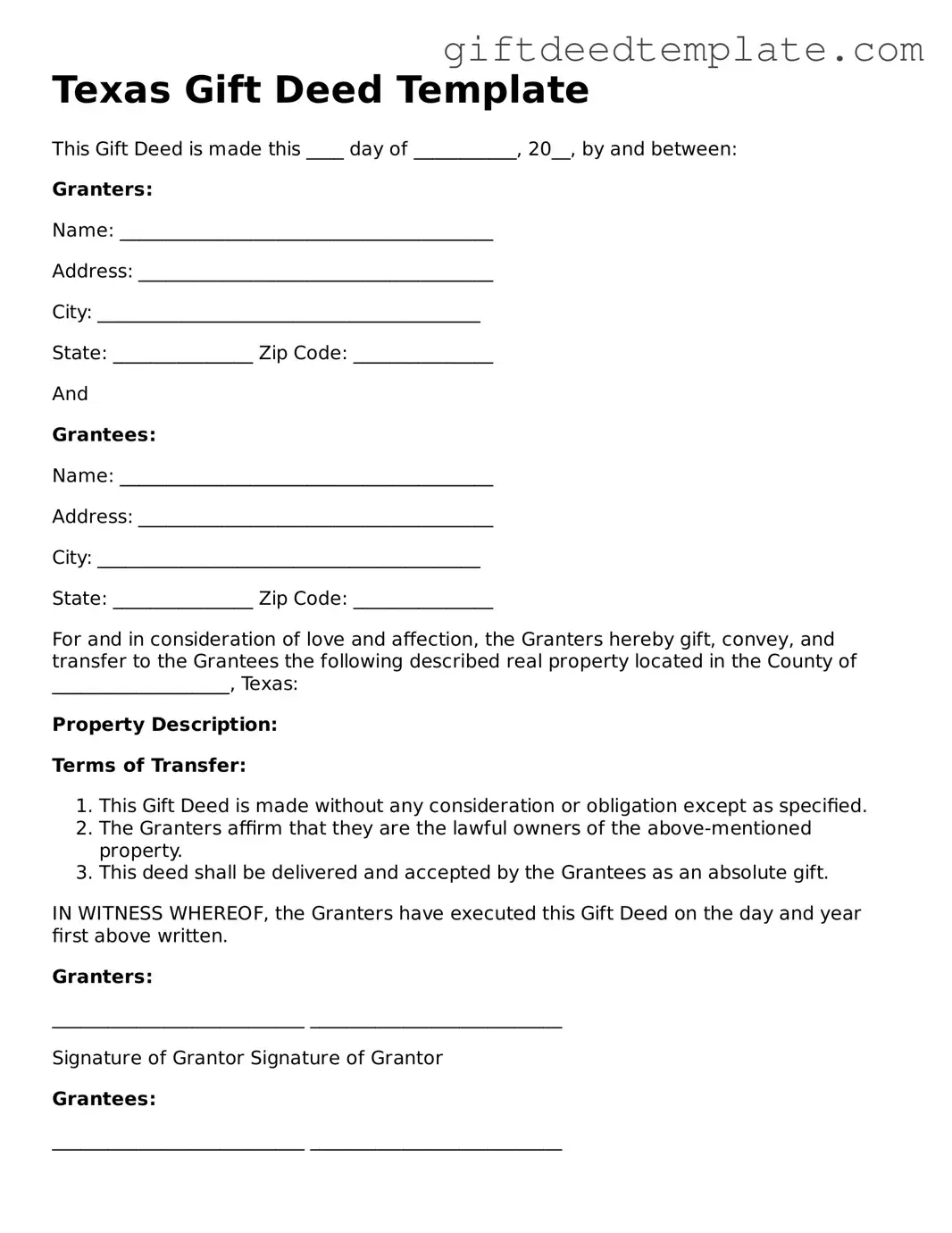

A Texas Gift Deed is a legal document used to transfer ownership of property from one person to another without any exchange of money. This deed is commonly used when someone wants to give real estate as a gift to a family member or friend. It clearly outlines the details of the property and the parties involved in the transfer. By using a Gift Deed, the giver can ensure that their intentions are documented and legally recognized.

Do I need to pay taxes on a property given as a gift in Texas?

In Texas, the recipient of a gifted property may not have to pay property taxes immediately, but they should be aware of potential tax implications. The IRS has rules regarding gift taxes. If the value of the property exceeds the annual gift tax exclusion limit, the giver may need to file a gift tax return. However, the giver typically pays any gift tax, not the recipient. It’s wise to consult with a tax professional to understand the specific tax responsibilities involved.

How do I complete a Texas Gift Deed?

Completing a Texas Gift Deed involves several steps. First, gather all necessary information about the property, including its legal description. Next, fill out the deed form with the names of the giver and recipient, along with any specific conditions of the gift. After that, both parties should sign the deed in front of a notary public. Finally, the completed deed must be filed with the county clerk’s office where the property is located to make the transfer official.

Can I revoke a Gift Deed in Texas?

Once a Gift Deed is executed and recorded, it generally cannot be revoked. The transfer of property is considered complete, and the recipient has full ownership rights. However, if the giver wishes to change their mind, they may need to consult with a legal expert to explore options, such as creating a new deed or pursuing legal avenues to challenge the gift. Always seek professional advice when dealing with property transfers to understand your rights and options fully.